Well, events 1030 and 1058 are very generic errors and can be caused by one of many different reasons. I often see questions at Experts Exchange on how to overcome these events. I don't have all the answers, but have helped out a lot of people diagnose and fix these events.

Explore Experts Exchange Articles

Our articles are written by a community of IT professionals and experts to provide insight on trending topics and common technology roadblocks.

Get AccessGet Access

Access our full library of articles written by our technology community. Read how-to guides, new perspectives on trending tech, and exclusive insights on industry news.

Articles For You

-

Python & SharePoint - Getting Data, Creating Lists and Uploading FilesFor most Python developers, Microsoft business software is either a great unknown or a necessary evil. Microsoft SharePoint is no exception. Yet, knowing how to integrate Microsoft SharePoint from Python can make all the difference. Plus, it is not that complicated!

-

Free in-place upgrade of Nuance PaperPort Professional 14.5 to Kofax PaperPort Professional 14.7Earlier this year, Kofax acquired Nuance's Document Imaging Division, which included PaperPort. Kofax recently released the first version of PaperPort under its stewardship — V14.7. This article explains Kofax's method for upgrading from PaperPort Professional 14.5 to Professional 14.7 at no cost.

-

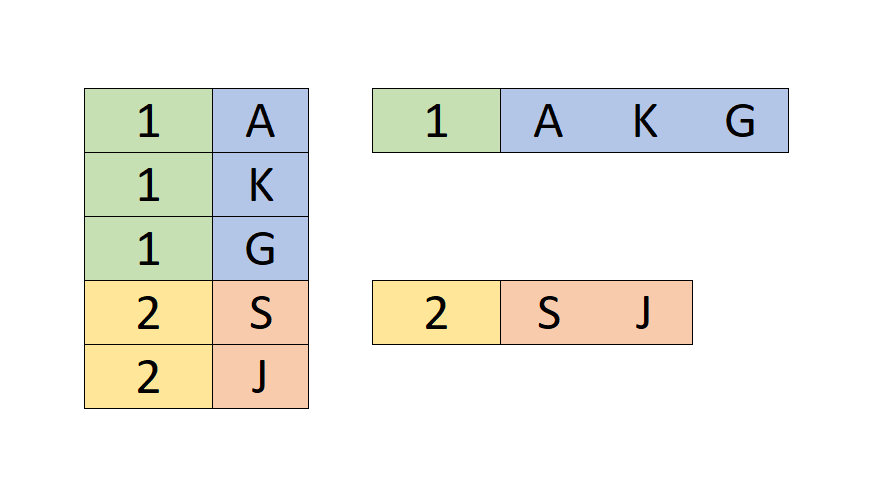

Join (concat) values from one field from a table or queryAs you can union records, you can join field values. Presented here, DJoin offers increased speed and flexibility compared to the ancient ConcatRelated and similar functions. Further, it offers better read-out of Multi-Value fields.

-

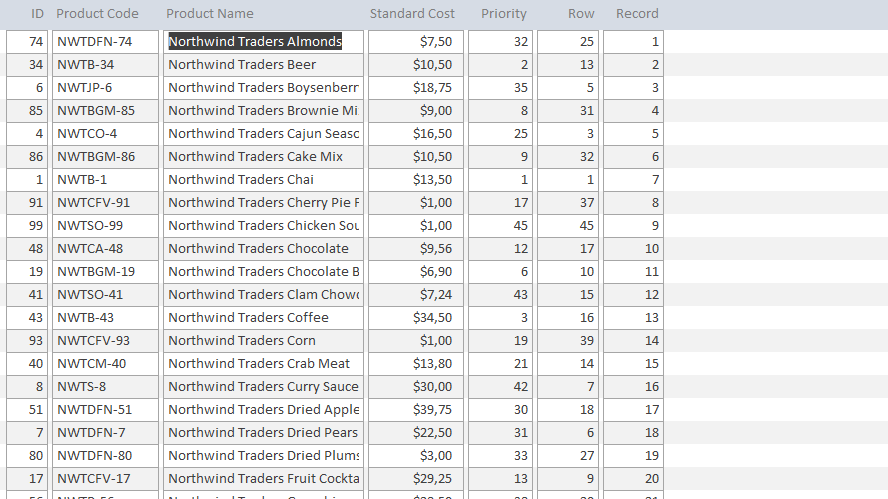

Sequential Rows in Microsoft AccessGenerating sequential numbers is quite easy, but making them persistent to form updates, deletes, sorting, and filtering takes a little more. Here we will show how to accomplish this in several ways with either little or no code.

-

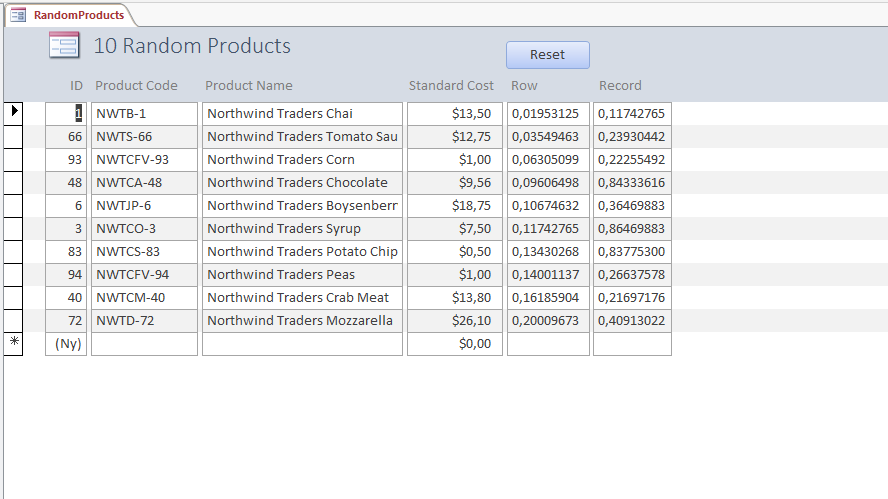

Random Rows in Microsoft AccessGenerating random numbers is quite easy, but making them persistent to form updates, deletes, sorting, and filtering takes a little more work. Here we will show how to accomplish this with a few lines of code.

-

Advantages & Disadvantages of Choosing AngularJS Web DevelopmentAngularJS web development a very simple procedure. So, to put it, in short, AngularJS’ stand out features are – Two-way data binding, MVC structure, directives, templates, dependency injections and testing.

-

Cyber Security in a Cyber WorldAn overview of cyber security, cyber crime, and personal protection against hackers. Includes a brief summary of the Equifax breach and why everyone should be aware of it. Other subjects include: how cyber security has failed to advance with technology, what hackers may target, more.

-

The simplest jQuery Accordion everHow to build a simple, quick and effective accordion menu using just 15 lines of jQuery and 2 css classes

Newest Articles

-

Improve Network Security – Separate DNS from Active DirectoryWhile deploying Active Directory with integrated DNS makes managing a domain easier, it does come with security risks. Separating out DNS can actually improve security and make things harder for a threat actor.

-

Stopping Backdoor Spam On Microsoft M365As organizations move from an on premises Exchange environment SaaS based M365. There are configurations that may allow email to slip in passed typical email filtering systems. This is all based on the configuration and described in this article, along with the solution.

-

Lessons Learned: Adding Used NVME Drive to HP ProLiant Server with ESXiInstalling used hardware in a home lab or other systems can have some challenges. Hopefully, the lesson learned here with a used NVMe drive will save someone else time and headache.

-

Exchange & Powershell is a Long HistoryA long time ago, Experts-Exchange asked me to write a little article about some Exchange interesting Powershell commands. But I was never able to finish it properly. Here is the result of this work. Exchange has been the first Microsoft product that really needed Powershell to work!

Featured Author

Armed with my expertise and open to new insights, I stride forward with confidence and humility

-

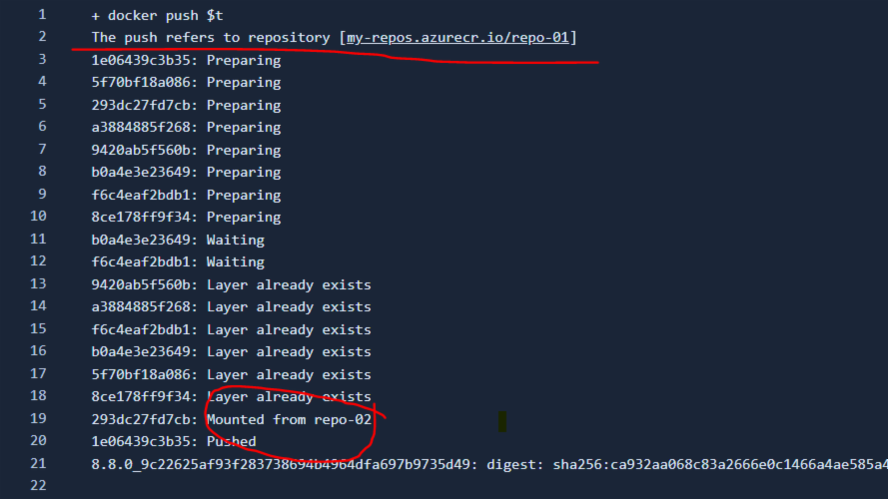

Demystifying Docker: Understanding 'Mounted from' in Push LogsDocker's 'Mounted from' message unveils a sophisticated layer-sharing mechanism, strategically reusing layers across repositories for efficient storage use and accelerated image operations

-

The Power of Closures in JavaScript: Understanding and Utilizing the ConceptClosures in JavaScript are powerful, allowing for state retention, currying and data persistence. This article offers a comprehensive guide to master closures, a fundamental concept for JavaScript development. Learn how to write more efficient and maintainable code using closures

Popular Articles

-

WARNING: 5 Reasons why you should NEVER fix a computer for free.It is in our nature to love the puzzle. We are obsessed. The lot of us. We love puzzles. We love the…

-

How Do I Know What to Charge as an IT Consultant?[This article first appeared as "Why are IT services so expensive?" in my first attempt at a blog. …

-

Why you shouldn't use PST filesThey have been around for years and for thousands of Microsoft Outlook users and email …

-

Migrate Small Business Server 2003 to Exchange 2010 and Windows 2008 R2This guide is intended to provide step by step instructions on how to migrate from Small Business …

-

Outlook continually prompting for username and passwordThere have been a lot of questions recently regarding Outlook prompting for a username and password …

Join a collaborative community of technology professionals.